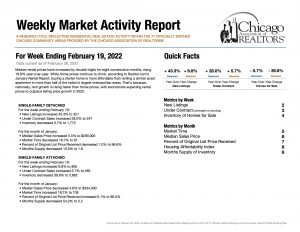

Welcome! To your “Weekly Market Activity Report for the Chicago Community” brought to you by Fast Stats and the Chicago Association of Realtors. This report is for the week ending on February 26th, 2022.

Hi, my name is Matthew Litzenberger. It is a pleasure to meet you. High Fives! The hope of this blog series is a no-fluff approach to Real Estate News. The short answers are underlined or Italicized (depending on what device you are on) and if you want to nerd out with me you can read my thoughts after that. Blessings.

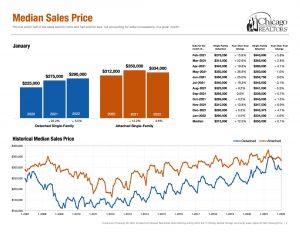

Detached Single-Family

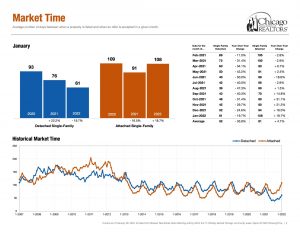

Healthy Market Time Range: ~ 52 days(yearly avg) ~61 Days(month of Jan 22′). The insight is if you are a seller going beyond this time range it means one of two things. 1) you are either an outlier (ie. a distressed or priceless property) 2) respectfully; you are overpriced. To sell, you may need to challenge what you believe the market should be with the reality of where it is. If the property listed was worth what the list price says it is, “Why has the listing not received any offers?” “Why have showings decreased on a listing?” It is not a lack of creativity or a lack of effort or even a lack of knowledge on the real estate partitioners part. It’s because the market has spoken in loud silence. They have seen our listing and have said, “No thank you.”

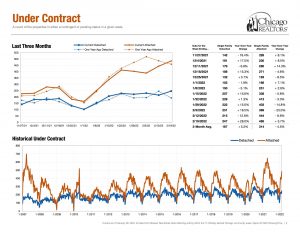

Under Contract: 271 properties (week ending in 2/26/2022) compared to last week we had 229 properties under contract. The insight is buying demand has increased in the last 7 days. Let us contrast this with the inventory.

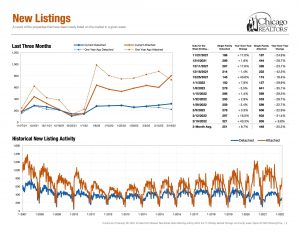

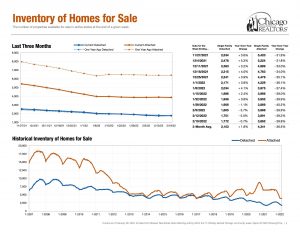

Inventory of Homes for Sale: 1,774 properties (week ending in 2/26/2022) (New Listings during the week of 2/26/2022: 325 properties) What does this mean? This shows that the supply in the Chicago Market is 1,774 and the demand is 271. Meaning if we take 1,774 divide that by 271 we get ~ 6.5. The insight to take from this is that a buyer in Chicago right now has the opportunity to “look around” at 6.5 properties and select which one they want from those options.

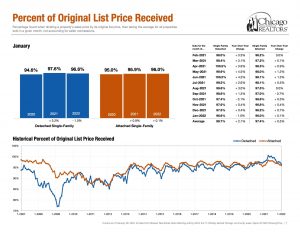

Percentage of Original List Price Received: ~ 96.6% (Jan 2022) ~98.7% (yearly avg) What does this mean? A question my clients ask: Matt what do you think is a good deal? or How much do you think we the seller is willing to “negotiate”? Good question. Let us not guess. Let us look at the data. Based on the last week of data of the properties that sold. Those sold properties sold between ~ 96.6% (Jan 2022) ~98.7% (yearly avg) of the original list price. Meaning and here is an example. Let’s say the property you like is listed at $400,000. We take $400,000 (multiply by)~96.6% between ~ 98.7% equals. The price range properties are being negotiated within is in a range of ~ 386,400 and ~ 394,800 (about). You can change the list price to make it more relative to you. There are many ways to look at this. Simply though, I’ve said it before, I’ll say it again: “Properly Priced Property Sells”. The market is trading and doing deals within this range of ~ 96.6% (Jan 2022) ~98.7% (yearly avg) of the original list price. Meaning that the market is about ~3.4%-1.3% overpriced; the sellers know it, the buyers know it. You are not getting a “discount” you are getting to pay 100% of ~ 96.6% (Jan 2022) ~98.7% (yearly avg) of what the market is worth. The idea that you are getting a deal is relative. The market bears what the property is worth.

Now let’s look at condos, townhouses, duplexes, etc.

Attached Single-Family

Healthy Market Time Range:~81 days(yearly. avg)~108 Days(month of Jan 22′) Meaning if you go beyond 108 days your property is respectfully overpriced. “Properly Priced Property Sells”. If the property listed was worth what the list price says it is, “Why has the listing not received any offers?” “Why have showings decreased on a listing?” It is not a lack of creativity or a lack of effort or even a lack of knowledge on the real estate partitioners part. It’s because the market has spoken in loud silence. They have seen our listing and have said, “No thank you.”

Under Contract: 523 properties (week ending in 2/26/2022) Compared to last week we had 464 properties under contract. The insight is buying demand has increased in the last 7 days. Let us contrast this with the inventory.

Inventory of Homes for Sale: 3,992 properties (week ending in 2/26/2022) (New Listings during the week of 2/26/2022: 677 properties)

Percentage of Original List Price Received: ~ 96.0% (Jan 2022) ~97.4% (yearly avg) What does this mean? A question my clients ask: Matt what do you think is a good deal? or How much do you think we the seller is willing to “negotiate”? Good question. Let us not guess. Let us look at the data. Based on the last week of data of the properties that sold. Those sold properties sold between~ 96.0% (Jan 2022) ~97.4% (yearly avg) of the original list price. Meaning and here is an example. Let’s say the property you like is listed at $400,000. We take $400,000 (multiply by)~96.0% between ~ 97.4% equals. The price range properties are being negotiated within is in a range of ~ 384,000 and ~ 389,600 (about). You can change the list price to make it more relative to you. There are many ways to look at this. Simply though, I’ve said it before, I’ll say it again: “Properly Priced Property Sells”. The market is trading and doing deals within this range of ~ 96.0% (Jan 2022) ~97.4% (yearly avg) of the original list price. Meaning that the market is about ~4%-2.6% overpriced; the sellers know it, the buyers know it. You are not getting a “discount” you are getting to pay 100% of ~ 96.0% (Jan 2022) ~97.4% (yearly avg) of what the market is worth. The idea that you are getting a deal is relative. The market bears what the property is worth.

Blessings & High Fives!

There you have it. Thank you for listening to my summary. Below is the report I look at to see where the market is; take a look and see if you agree. Stay tuned for more weekly and monthly content. If you are interested click on my linktree below to follow me on socials and check out my blog for more and different topics. I hope this was helpful to you. For any further explanations or if you would like to talk with me and interview me if you are looking for a real estate agent in Chicago, we can set up a time to talk together and see if we are a good fit to reach your real estate goals. May your day be a blessed one. High Fives!

https://linktr.ee/MatthewLitzenberger

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link