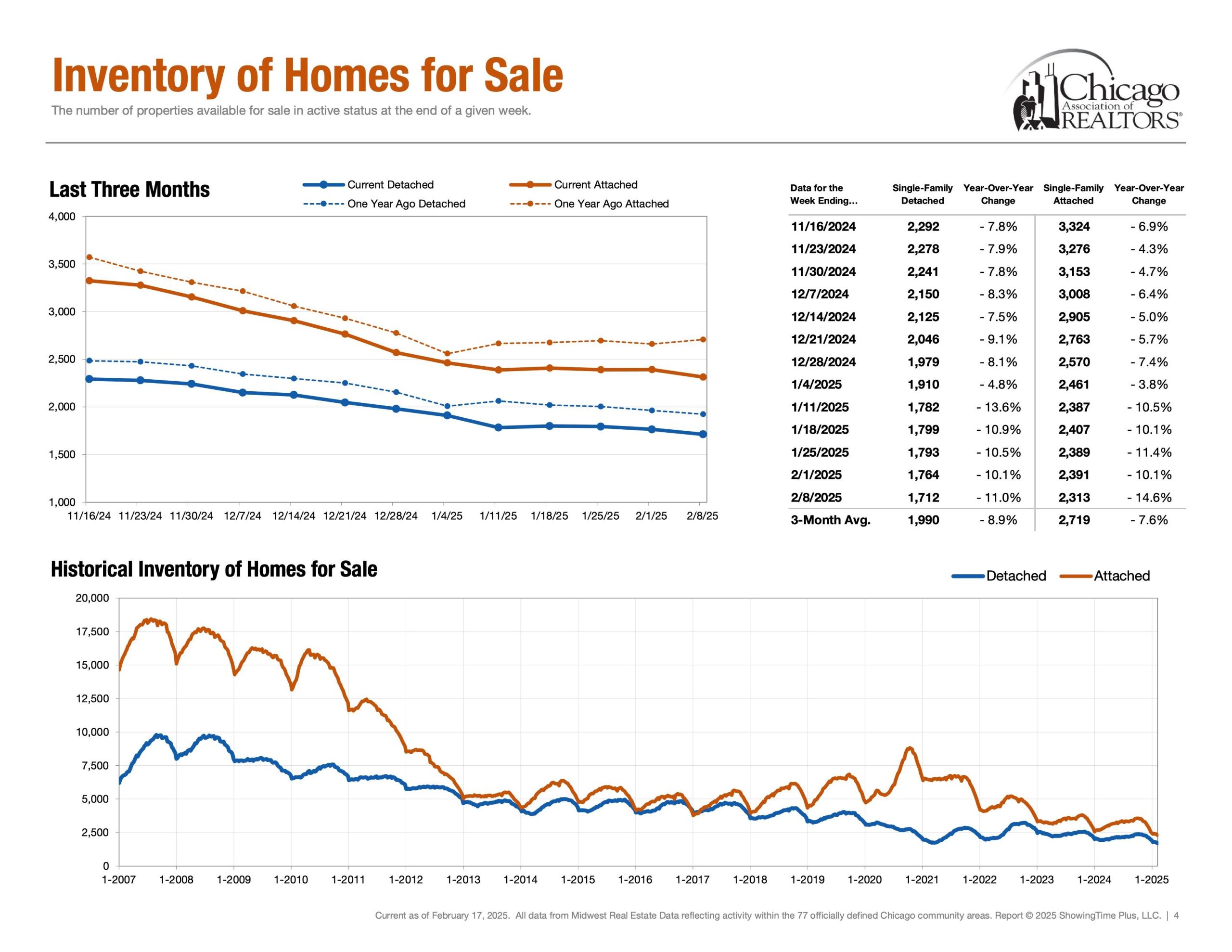

January 2025 | Week 6

Matthew Litzenberger a third generation Realtor with Coldwell Banker Realty helps buyers and sellers understand Chicago Real Estate Market metrics. Follow along for weekly updates on all things Chicago Real Estate by clicking here.

Introduction

Hello and welcome. This weekly series is aimed to help understand current Chicago Real Estate Market Metrics. While there are many metrics to talk about in the world of real estate, today we are going to look at four: speed, demand, supply and negotiations. Let’s get started!

Summary | TLDR

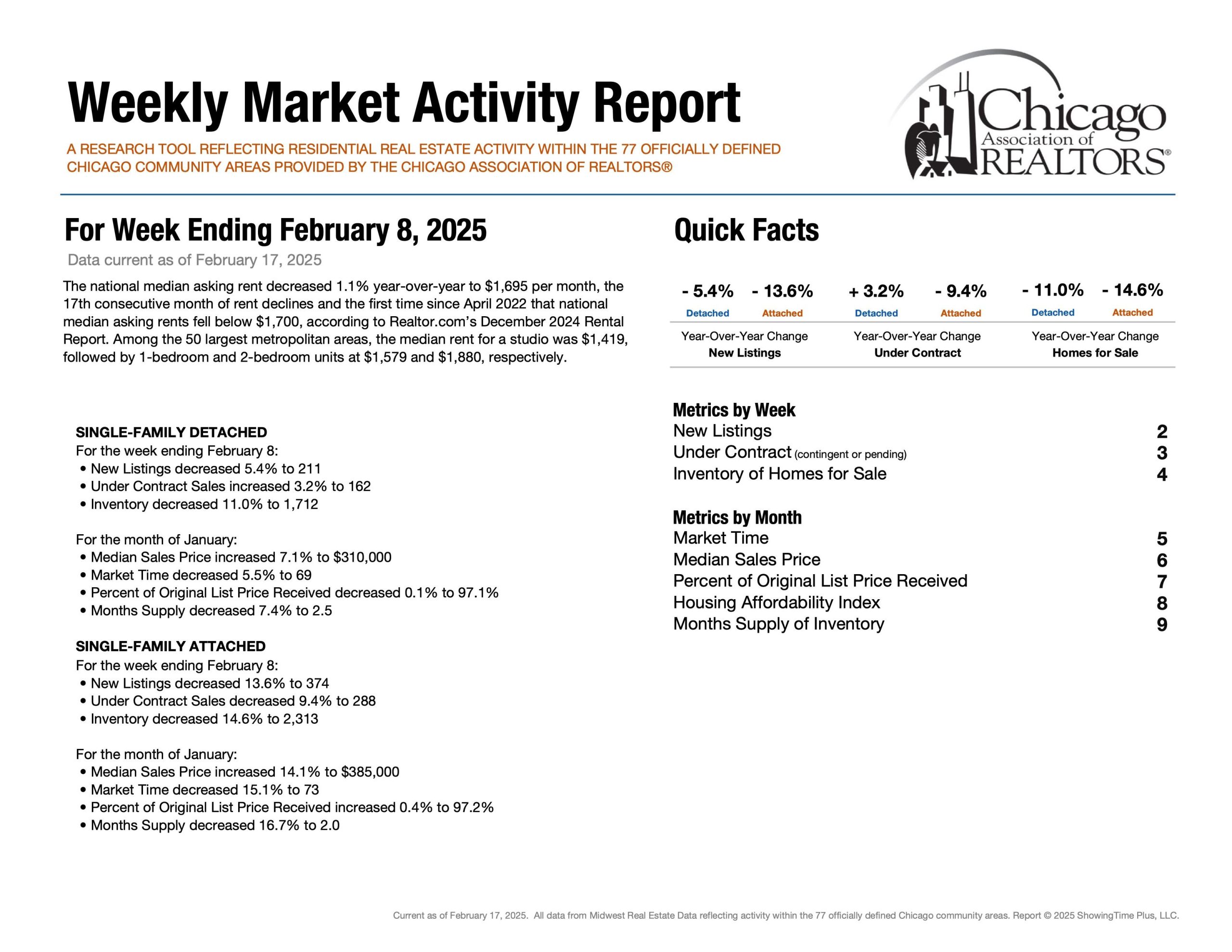

Supply | New Listings: Detached -5.4% & Attached -13.6%

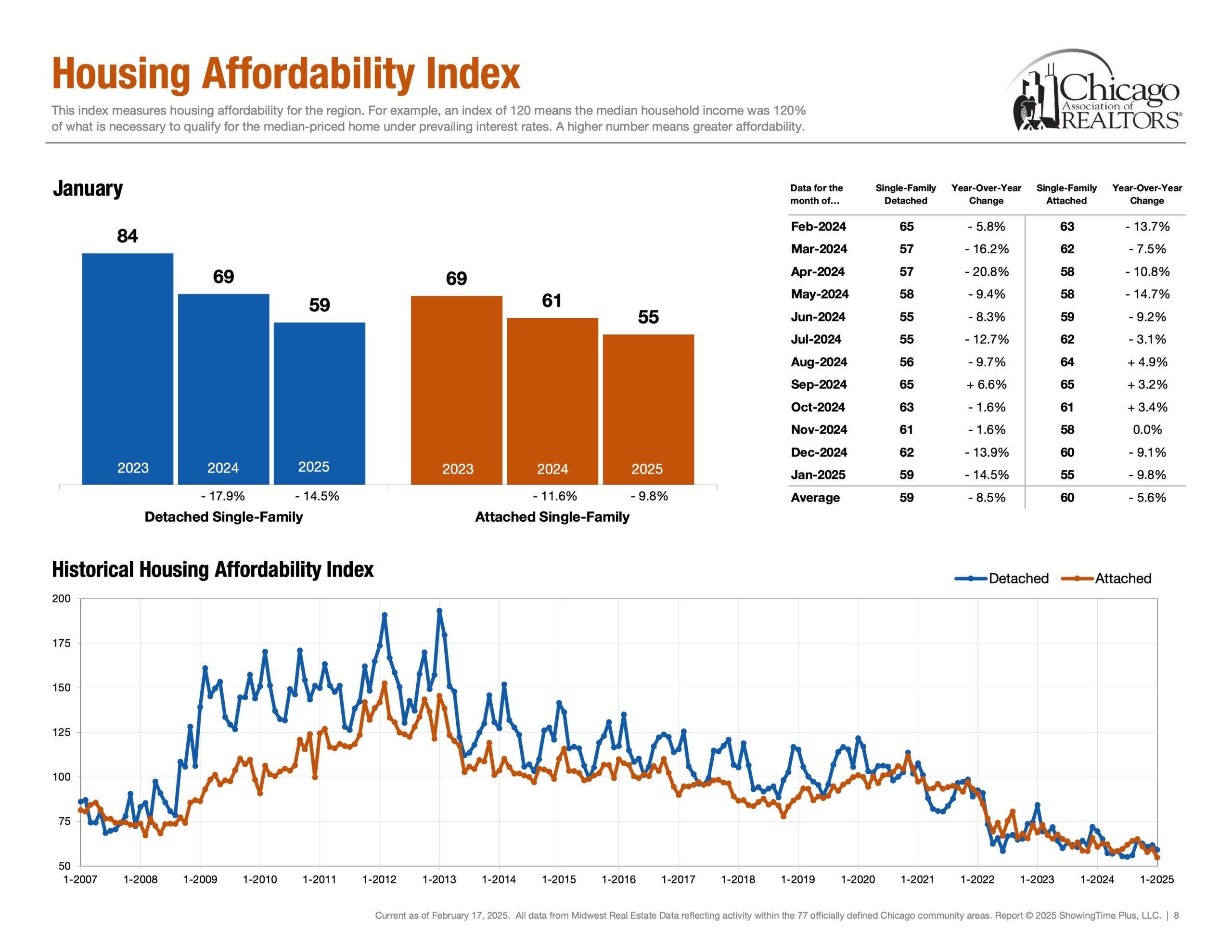

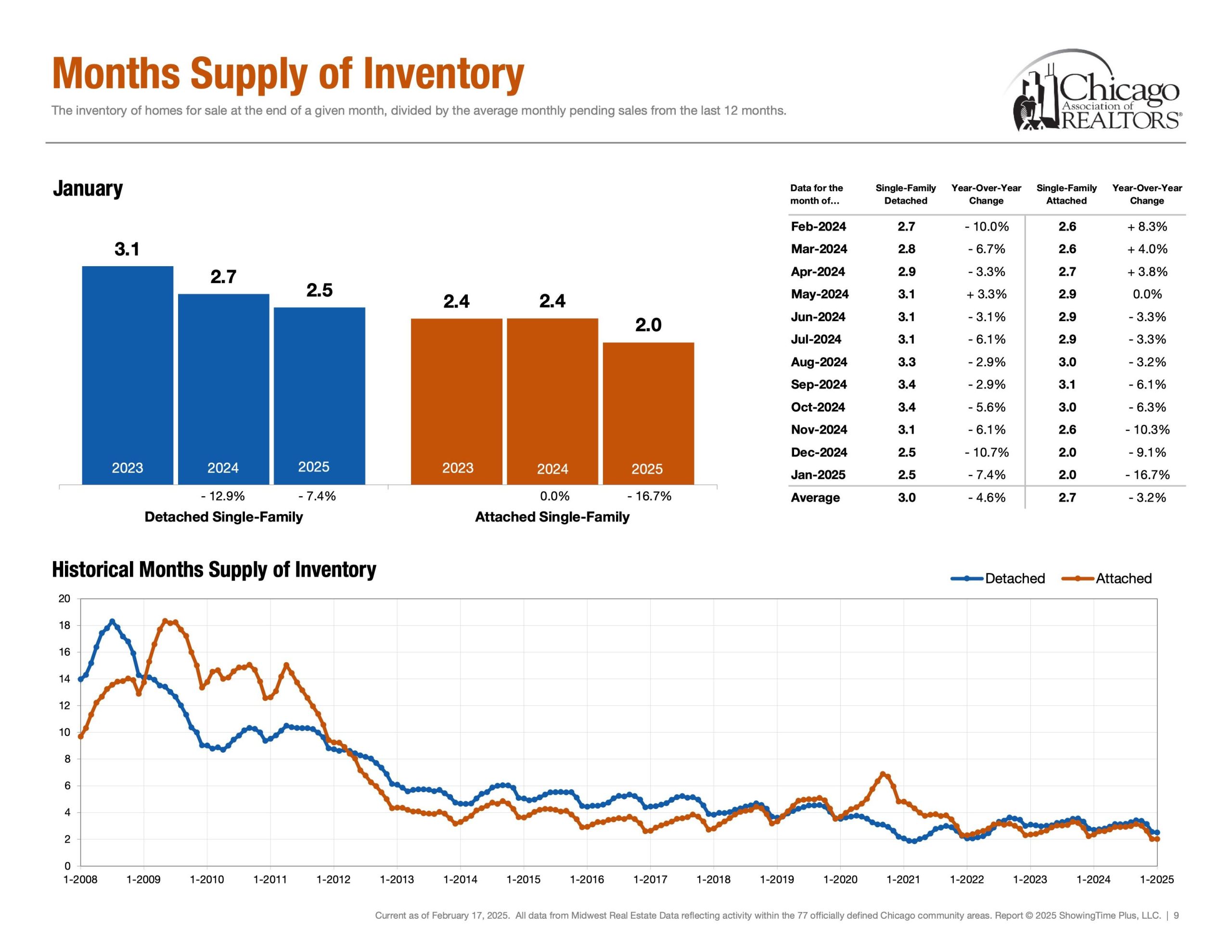

New Listings are losing pace resulting in Inventory of Homes for Sale to have HISTORIC LOWS (since 07). Affordability (economic middle-class) has fallen to lower levels than the housing crisis. Any award no one wanted to win.

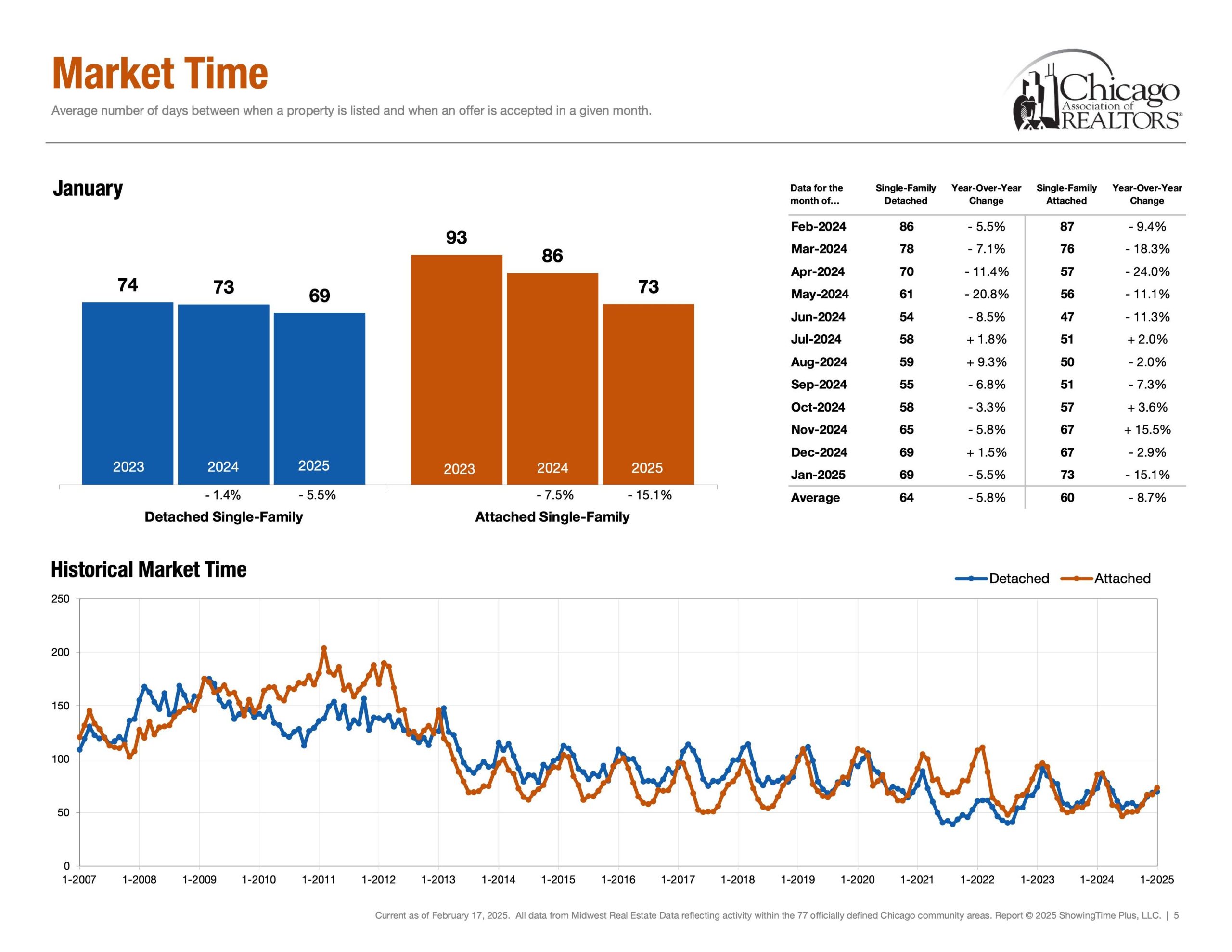

Speed | Healthy Market Time Range

Detached Single ~ 69 Days (Jan 25′)

Attached Single ~ 73 Days (Jan 25′)

First, market time is metric that showcases speed and whether a listing was priced too low, priced properly or priced too high. If a listing surpasses average days on market, it is a check engine light that your listing maybe overpriced. Interestingly, Dec 2024 Year over Year change for Market time was 0.0%, 68 days on Market. Please note that Market Time in our context measures the distance from when a property was listed and when an offer was accepted in a given month.

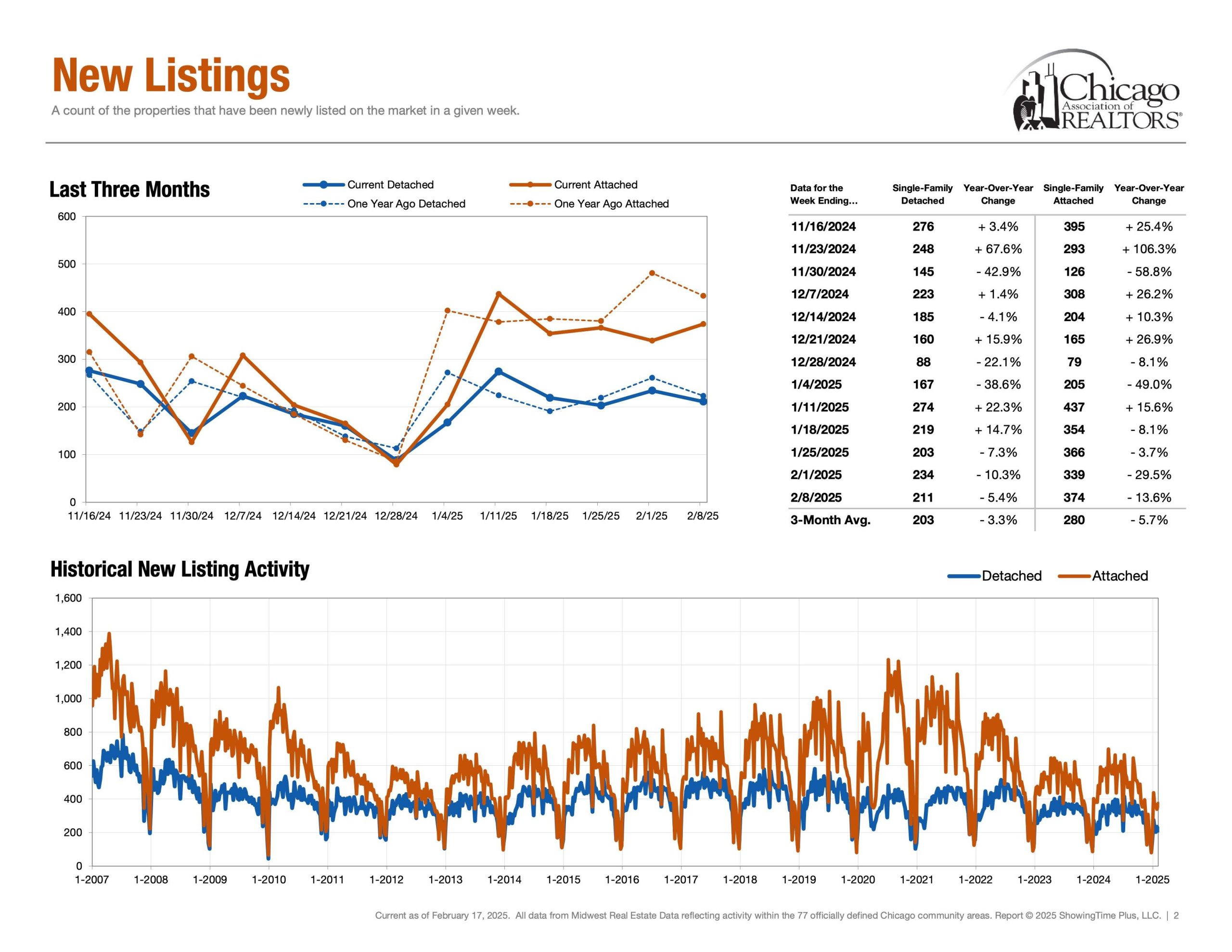

Demand | Under Contract

Detached Single = 162 Properties (Feb 2nd – Feb 8th)

Attached Single = 290 Properties (Feb 2nd – Feb 8th)

Secondly, under contract helps answer the question, “In our current market, how many buyers are buying?” Showcasing the heartbeat of the real estate market. Interestingly, demand metrics become more insightful when compared and contrasted with supply/inventory metrics. Demand spiked this week. Suppassing last year. Detached +27.0%. Attached +34.5%.

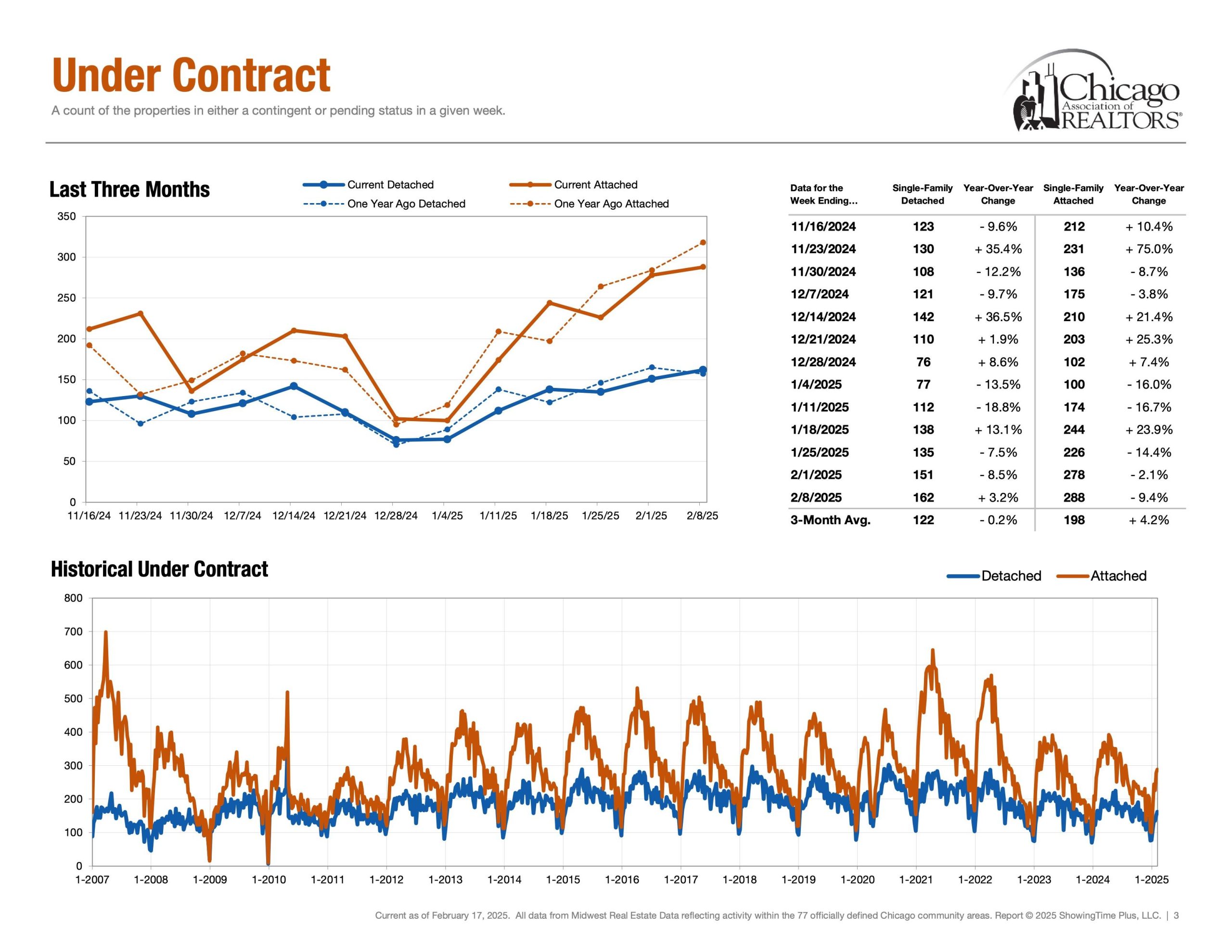

Supply | Inventory of Homes for Sale

Detached Single = 1,712 Properties (Feb 2nd – Feb 8th)

Attached Single = 2,313 Properties (Feb 2nd – Feb 8th)

Next, probably the metric of the year. Inventory of homes for sale showcases supply and answers the question, “How much inventory is available for buyers and how much competition sellers are up against?” Additionally, Months of Inventory, Homes for Sale, New Listings and Absorption Rate are also other key metrics in the conversation of supply.

Supply | New Listings

Detached Single = 211 Properties (Feb 2nd – Feb 8th)

Attached Single = 374 Properties (Feb 2nd – Feb 8th)

New Listings is a foreshadowing metric and helps visualize when inventory enters the market.

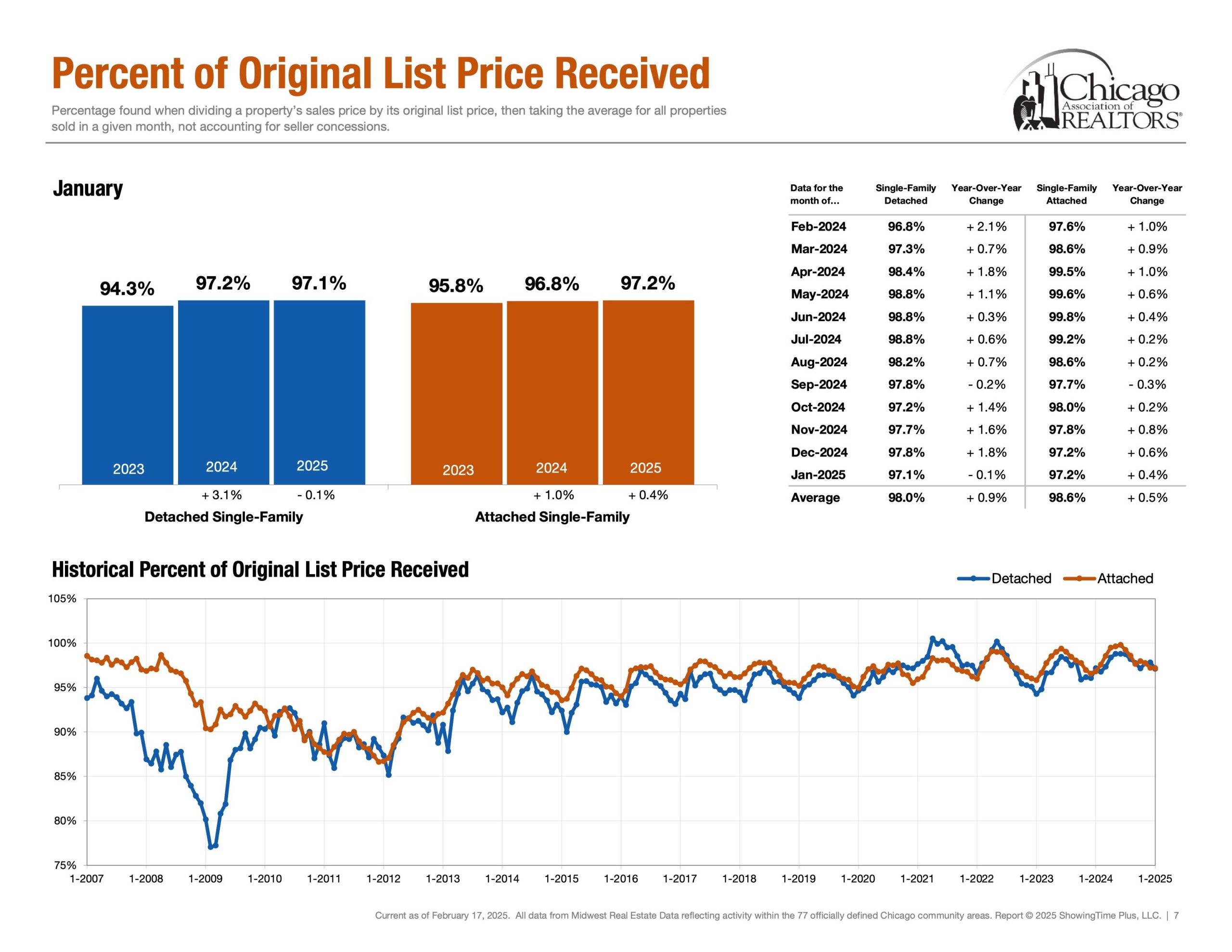

Negotiations | Percentage of Original List Price Received

Detached Single ~ 98% (Rolling 12 Months Avg) & ~ 97.0% (Jan 25′)

Attached Single ~ 98.6% (Rolling 12 Months Avg) & ~ 97.2% (Jan 25′)

Lastly, Percentage of Original List Price Received to Closed Price is a metric that showcases what the average accepted purchase price is relative to the list price. How much below asking price can an offer go while still getting accepted? How much would one have to offer above ask in order to be an above average purchase price?

The End | Have A Great Day!

Please note all of these metrics are along a spectrum as opposed to a specific number. Below is “The Weekly Market Activity Report” which is a research tool reflecting residential real estate activity within the 77 officially defined Chicago community areas provided by the Chicago Association of Realtors®. It is essential to keep in mind that real estate markets can vary across neighborhoods and property types within a city. In conclusion, economic conditions and external factors can influence market trends. Staying updated on these metrics and trends is crucial for making informed decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link